There’s a lot of pressure on candidate sourcing in today’s recruiting marketplace at large.

In real estate terms, it’s a buyer’s market: there are lots of traditional jobs (listings) available and few capable, qualified, and motivated employees (buyers) to take these positions.

Individuals who are willing and able to work have lots of choices when looking for new opportunities.

In turn, employers are now forced to compete more rigorously for the attention of candidates. This drives up the cost of marketing and lead generation.

For many companies, this also means fewer candidates are entering their pipelines.

On the surface, this appears to be a detriment to the hiring process (and for some companies, it is).

However, there are some hiring managers and recruiting coordinators who seem to be “making more” of fewer candidates. Take a look at the results of this quick case study.

Recruiting Execution Metrics

From a recruiting metrics perspective, we encourage our clients to track the following six metrics:

Candidates Sourced/Month: Individuals who show interest in working for your company apply and give permission to be contacted.

Interview Rate: Percentage of the candidates completing face-to-face interviews.

Interview to PLQ: Percentage of interviewees who commit to attending licensing school. PLQ is an abbreviation for pre-licensing queue.

Lost to Competitor: Percentage of interviewees who get hired by competitors.

Hire Rate: Percentage of interviewees who get hired by your company.

Total Number of Hires: The most important metric of all.

The Tale of Two Quarters

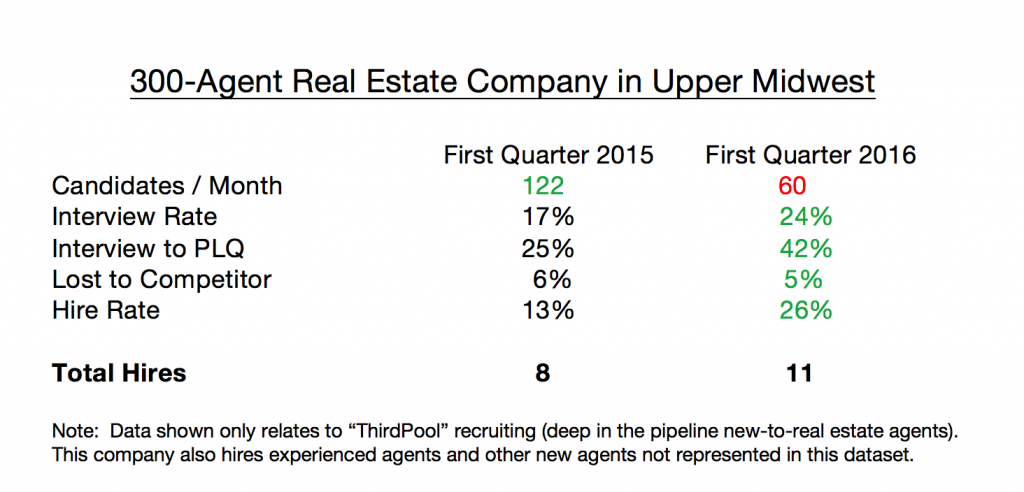

Recorded below are the first quarter “ThirdPool” recruiting results for a 300-agent company in the Midwest. I will not share the company’s name because I didn’t’ get permission from them before publishing. However, this company has been a client for several years, and we track their recruiting metrics very closely.

While the candidate sourcing volume is nearly half of what it was during the same period the previous year, all the recruiting execution metrics have increased significantly (with the exception of Lost to Competitor).

The most interesting increase is total hires—a 50% reduction in sourcing has resulted in total hires increasing by more than 30%.

This company had 32 ThirdPool hires in 2015. They’re on track to hire 44 in 2016.

What’s Going On?

This trend is not just happening with one company—we’ve observed this shift with multiple companies after reviewing first quarter results. While it is not evident in every company yet, it’s becoming frequent enough to start asking some questions.

Why is this happening?

At this point, we’re not sure of the answer. Are this year’s candidates a higher quality? Are the 50% of “missing candidates” the ones who were less likely to move forward in the hiring process? Are recruiting coordinators doing more meaningful recruiting tasks (as opposed to managing a fire hose of candidates coming at them each month)?

Is this trend sustainable?

We may need more data and time to know the answer. The trend looks good at this point (most pipelines are healthy), but a few quarters of sustained hires would make everyone more confident.

In the upcoming weeks, we’ll be revisiting this topic from multiple angles.

In the mean time, what are your thoughts?

If you’d like to share your experience and perspective on this topic, email me at workpuzzle@hiringcenter.net

Questions or Comments? Reply to your WorkPuzzle subscription email.

Didn’t get the WorkPuzzle email? Subscribe below. We promise not to share your email with others or use it for any other purpose but delivering WorkPuzzle notices.