I just returned from a trip to the East Coast where I had the opportunity to spend some time with the owners and executive teams of several of our clients. While my mission was to give presentations on the best practices of both new and experienced agent recruiting, I think I brought back more information than I provided…as is often the case.

One of the common themes I heard as I listened to the recruiting challenges and obstacles that hiring managers face is that an increasing number of candidates are facing financial challenges with regard to starting careers as real estate agents.

On the surface, it appears that the problem lies in the fact that candidates are just short of cash… However, as I started to question this premise, I quickly learned that the problem is more complex. The real issue has to do with perception.

From the candidate’s perspective, the risk-to-reward ratio in the real estate industry has risen to an unacceptable level.

Let me explain. When the real estate industry was growing aggressively in years past, the perception was that a significant amount of money could be made by venturing into this career field. While the risk (start-up cost, lost opportunity of doing something else, potential of failing as an agent, etc.) was just as substantial back then as it is now, the chance of a potential payoff was much higher.

So, the perception of declining rewards is the real problem. Financial backing has a way of surfacing when a person believes a considerable reward can be reasonably attained. This is why there is more than $1 trillion in education loan debt in the United States.

So, how do you convince a skeptical public that opportunity still exists in the real estate industry?

One way to do it is through the use of data. To show how this can be done, I’d like to introduce you to Tom Prall. Tom is the owner of Carpenter Realtors, a very successful 30-office real estate company in Indianapolis.

If you walked into Tom’s office, you’d see stacks of research on his desk that he skillfully uses to guide his company. If you went to one of his sales meetings, you’d be handed paperwork that meticulously describes, from a data perspective, the business reality of what is going on around you. And, if you’re engaging Tom in a conversation, you best have some data to back up your assertions—otherwise it gets a little uncomfortable.

If you walked into Tom’s office, you’d see stacks of research on his desk that he skillfully uses to guide his company. If you went to one of his sales meetings, you’d be handed paperwork that meticulously describes, from a data perspective, the business reality of what is going on around you. And, if you’re engaging Tom in a conversation, you best have some data to back up your assertions—otherwise it gets a little uncomfortable.

In a recent email exchange, I told Tom that some candidates are losing hope in the career potential that real estate has to offer. Shortly thereafter, I got a phone call that started… "Ben, I don’t think you’re looking at this correctly…"

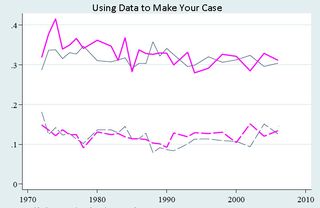

During the course of our phone conversation, Tom laid out a case that now is the time for young candidates to embark on a real estate career. The case was built on an analysis that included the total number of transactions, total number of agents, and per agent productivity averages for the Indianapolis market.

The analysis also included trending from a peak in the market in 1979 that closely resembled the peak in the market in 2006. He also tracked what happened during the subsequent six years in both cases.

Something interesting emerged in Tom's analysis: There is a tipping point when the per agent productivity averages start to grow by more than 10% year over year. In the Indianapolis market, there are indicators that strongly suggest this tipping point will be crossed in 2012, thus making it a advantageous time to begin working as a new real estate agent. The “economic wind” will likely be at a candidate’s back for the first time in six years!

I believe Tom has figured out something very important:

If you’re going to be successful at hiring under today’s market conditions, you need to be able to make a compelling case that the “reward” in the risk-to-reward ratio is both real and significant.

If you’re accustomed to using anecdotal evidence, dated testimonials, or even cute stories about agent hires of the past, you may find yourself coming up short when it comes time to convince the best and brightest to join your team. Like Tom has illustrated, be ready to have a serious, data-driven, business discussion about the financial prospects of becoming a real estate agent.

By doing this, you’ll be better prepared to defuse the objections candidates have about start-up costs and initial risks. If the reward part of the equation is compelling, candidates will again become motivated to find the money to get started.

Here's some homework for you. Create one of two presentation items (a graph, a chart, an illustration, etc.) that demonstrate that now is the right time to become a real estate agent. Print these items out and be ready to use them during your next interview.

Editor's Note: This article was written by Ben Hess. Ben is the Founding Partner and Managing Director of Tidemark, Inc. and a regular contributor to WorkPuzzle. Comments or questions are welcome. If you're an email subscriber, reply to this WorkPuzzle email. If you read the blog directly from the web, you can click the "comments" link below.

Editor's Note: This article was written by Ben Hess. Ben is the Founding Partner and Managing Director of Tidemark, Inc. and a regular contributor to WorkPuzzle. Comments or questions are welcome. If you're an email subscriber, reply to this WorkPuzzle email. If you read the blog directly from the web, you can click the "comments" link below.