What is the most variable process in most real estate companies?

By variable, I mean the process you can least depend on to produce consistent month-to month results. Also when results change (an increase or a decrease), you usually have no idea what’s causing the variability.

You guessed it—it’s recruiting.

I have yet to meet any real estate leaders who describe their recruiting process as constant and dependable.

Why does this matter? Because basic financial theory reminds us that processes that produce reliable results are the most valuable.

If you can turn your recruiting process into a predictable system producing repeatable and reliable results, you create future cash flows–the thing every business needs to insure their on-going survival.

During our recent Edge Conference, we spent time investigating the psychology of execution under the guidance of Dan Stull.

Dan is a successful entrepreneur and a very talented business thought leader. He has more than 25 years experience in direct mergers and acquisitions, divestitures and corporate development activities across various industries. He is also an instructor at the University of Washington where he specializes in helping business leaders execute more successfully.

Financial Theory

On the topic of execution, Dan’s “big idea” for the group was:

Reducing Variations in Processes Increases the Value of Those Processes

Read this statement a couple of times and digest it’s meaning.

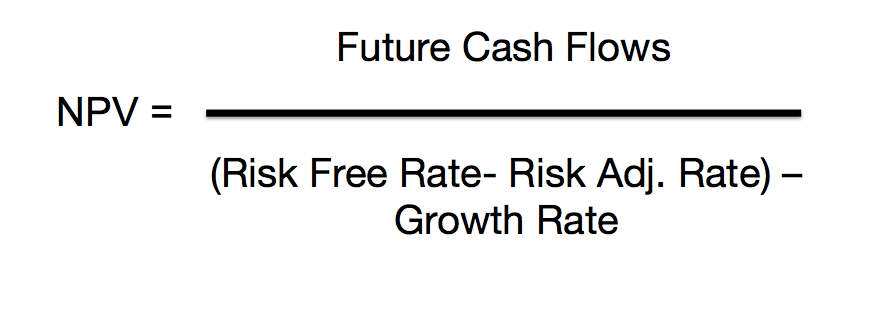

In the world of financial theory, this statement relates to the following formula:

The value of an asset (your company) is directly related to the net present value (NPV) of that asset’s future cash flows. As risk increases, the value of the asset is diminished.

If a process (like recruiting) is highly variable, it’s more risky (i.e. the output is unreliable—you don’t know what you’re going to get). It causes a reduction in the NPV.

If a process is very stable and predictable, it’s less risky (i.e. the output is reliable—you can depend on a consistent result). It increases the NPV.

Increasing a Real Estate Company’s Value

In financial terms, increasing the value of the company is the appropriate and noble objective of all businesses.

As a member of a company, it’s your job to make a viable contribution to this objective.

The most direct way to make that contribution is by following Dan’s advice: reduce the variation in one or more of the processes that make up the business. If accomplished successfully, this activity increases the value of the company.

For a real estate company, the most variable process is typically recruiting. It’s the natural place to focus if you want to increase value.

Increasing Your Value

Of course, if you’re the person who makes a measurable contribution to this objective, you’ve made yourself more valuable to the organization.

How do you make this contribution? We’ll cover this topic in our next WorkPuzzle. Some of the most mature parts of the economy have something to teach real estate companies about process improvement.

Questions or Comments? Reply to your WorkPuzzle subscription email.

Didn’t get the WorkPuzzle email? Subscribe below. We promise not to share your email with others or use it for any other purpose but delivering WorkPuzzle notices.